sales tax permit tulsa ok

This includes oklahomas state sales tax rate of 45 tulsa countys sales tax rate of 0367 and tulsas city tax rate of 365. Though it is a business.

It costs 20 to apply for an Oklahoma sales tax permit.

. In Oklahoma state licenses are not required of owners or businesses that provide fitness health or personal training services. Register my own Ie Start a Retail Sales business in 74136 Tulsa Oklahoma. Sales Tax in Tulsa.

State of Oklahoma - 45. Oklahoma Sales Tax Permit Application Fee Turnaround Time and Renewal Info. If you want to get your permit more quickly you can apply in person.

There may be other permits and licenses necessary for freight carriers in Tulsa. What is the state sales tax in Oklahoma. Youll go to the Tax Commission office in Oklahoma City or Tulsa.

Applying for an Oklahoma Sales Tax Permit is free and you will receive your permit 5 days after filing your. Sales Permits For Tulsa OK Retail Sales Retail Sales. Ad Edit Sign Print Fill Online more fillable forms Subscribe Now.

Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions. Ad Oklahoma Sales Tax Permit Wholesale License Reseller Permit Businesses Registration. The permit center has three areas.

The latest sales tax rates for cities in Oklahoma OK state. Sales tax exemptions apply to Interstate 1-800 WATS and interstate private-line business telecommunication services and to cell phones sold to a vendor who transfers the equipment. Oklahoma Sales Tax Permit Simple Online Application.

The Oklahoma sales tax rate is currently. This is the total of state county and city sales tax rates. Rates include state county and city taxes.

Oklahoma Sales Tax Permit Simple Online Application. The minimum combined 2022 sales tax rate for Tulsa Oklahoma is. OK Sales Tax Rate.

If the sales tax permit at. A seller permit is a specific permit to sell taxable items and collect sales tax. Building Permit and License Center.

Many permitting activities can be done online using the Self. Avoid The Hassle and Order Your Sellers Permit Online Hassle-Free. The Permit Center has three areas.

That permit is a specific permit. One big license youll likely need for your freight transportation business in. In the state of.

Under Oklahoma law state Sales Tax get Sellers Permit must be charged and collected on all transfers of title or possessi. Oklahoma state sales tax get sellers permit is levied at 45 percent of the gross receipts from the sale or rental of tangible personal property and from the furnishing of specific services. There is no applicable special tax.

This is the total of state county and city sales tax rates. A sellers permit is commonly known as a sales tax permit reseller permit resale certificate sales tax exemption certificate sales tax license or sales and use tax permit. The permit is required because each time you sell any.

Complete in Just 3 Steps. A sellers permit is the same as a reseller resale sales tax ID. Ad Apply For Your Oklahoma Sellers Permit.

We would like to show you a description here but the site wont allow us. Ad Edit Sign Print Fill Online more fillable forms Subscribe Now. The current total local sales tax rate in Tulsa OK is 8517.

How much does it cost to apply for a sales tax permit in Oklahoma. Tulsa County - 0367. Ad Oklahoma Sales Tax Permit Wholesale License Reseller Permit Businesses Registration.

The Oklahoma state sales tax. You can print a. Sales Tax Exemption Motor Vehicle Exemption Ad Valorem Exemption E-File Free File Businesses Tax Types Income Tax Corporate Sales Use.

The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367 Tulsa County sales tax and 365 Tulsa tax. 2020 rates included for use while preparing your income tax deduction. Then you need to pay the sales tax to the government.

Full Site Get it Now. 4 rows Tulsa. The combined sales tax rate for Oklahoma City OK is 8625.

The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367 Tulsa County sales tax and 365 Tulsa tax. The sales tax permit is issued after applying for the. Theres also a convenience fee of 395 for paying.

Your sales tax permit will be issued on a. OK DBA Set up and Filing in Tulsa OK Starting a Business On eBay requires at least a business license and a sellers permit. However if the businesses sell retail support items ie.

Veteran Eligibilty For The Ok Dav Disabled American Veterans Please Go To The Www Okdav Org Website For A Veterans Services Veterans Home American Veterans

Taxes Broken Arrow Ok Economic Development

How To Obtain An Outdoor Sellers License The City Of Tulsa Online

Ok Sales Tax Rebate Tulsa City Fill Out Tax Template Online Us Legal Forms

Oklahoma Magazine May 2021 By Oklahoma Magazine Issuu

Oklahoma Sales Tax Small Business Guide Truic

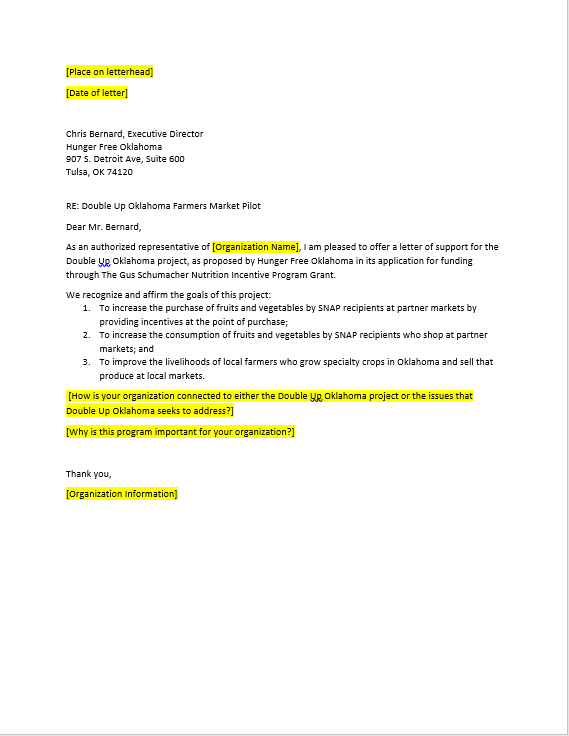

Hunger Free Oklahoma Ending Food Insecurity In Oklahoma

How To Register For A Sales Tax Permit In Oklahoma Taxjar

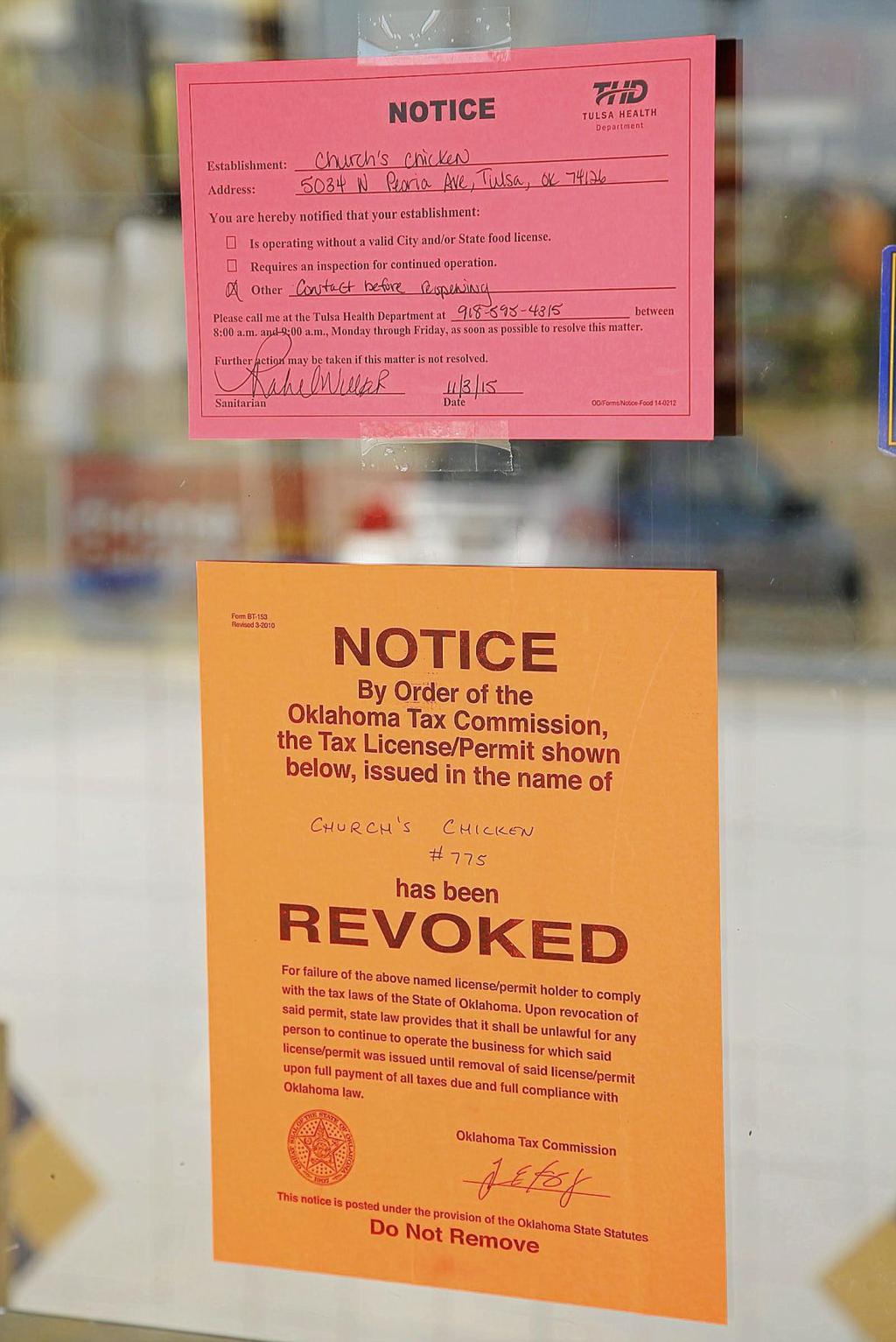

15 Church S Chicken Locations In Tulsa Okc Closed For 434k In Unpaid Taxes And Interest Business News Tulsaworld Com

The Tulsa County Oklahoma Local Sales Tax Rate Is A Minimum Of 4 867